The latest edition of the FinTech Ecosystem Newsletter is here:

Image Credits: shutterstock.com

The latest edition of the FinTech Ecosystem Newsletter is here:

Image Credits: shutterstock.com

The latest edition of the FinTech Ecosystem Newsletter is here:

Image Credits: shutterstock.com

The latest edition of the FinTech Ecosystem Newsletter is here:

Image Credits: shutterstock.com

The latest edition of the FinTech Ecosystem Newsletter is here:

Image Credits: shutterstock.com

Join our community of 50,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter provided by Bussmann Advisory. Gain insights into disruptive technologies, industry updates, and success stories from our portfolio companies.

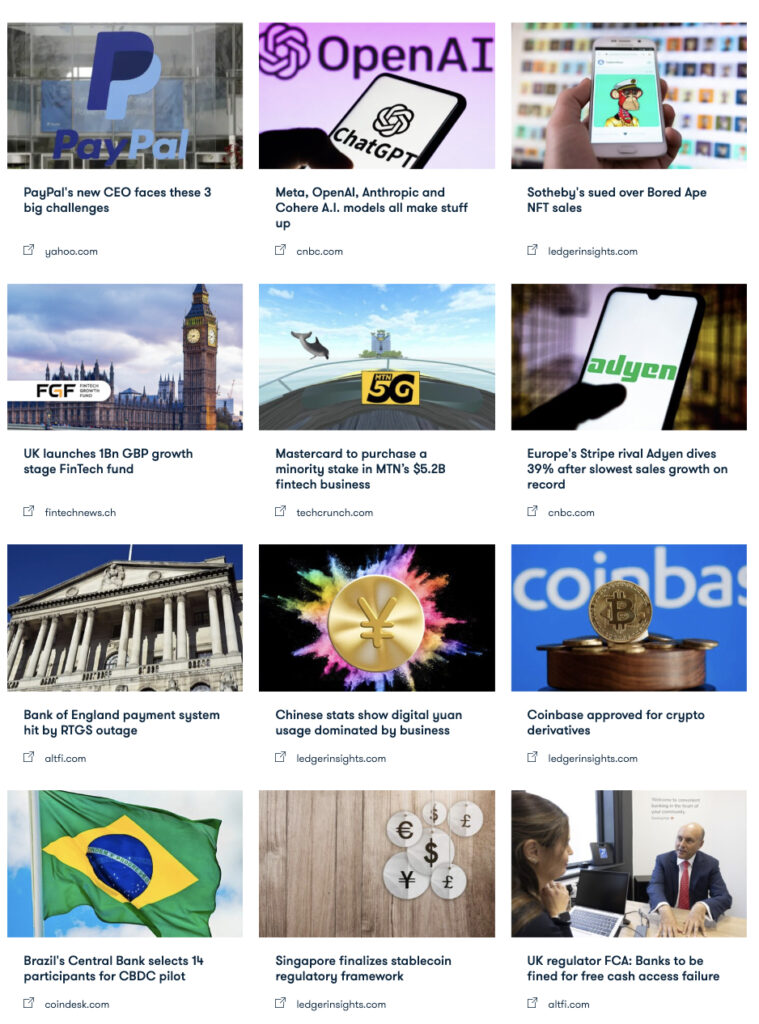

This week’s must-know stories:

While the rise of generative AI, like ChatGPT, has sparked concerns over job displacement, new roles are emerging that focus on reviewing AI outputs. Prolific, a UK-based company, compensates individuals for reviewing AI-generated content. The company collaborates with major entities like Meta, Google, and academic institutions. These human reviewers provide essential feedback on AI outputs, ensuring accuracy and preventing harmful content generation. The CEO of Prolific, Phelim Bradley, emphasizes the importance of “AI workers” in shaping AI models and ensuring ethical AI development. Source

Amundi, one of Europe’s largest asset managers with over $2 trillion in assets, is exploring the tokenization of money market funds in Italy. Gabriele Tavazzani, CEO of Amundi Italy, envisions creating the first tokenized fund under Italian law, which would be open, digitally native, and fungible. This move aligns with Italy’s growing interest in tokenization, with other firms like Azimut and MedioBanca also venturing into this space. Source

JP Morgan’s Onyx division has launched its TCN, with BlackRock and Barclays initiating transactions on the platform. The inaugural transaction involved BlackRock tokenizing shares in its Money Market Fund and using them as collateral with Barclays for a derivatives contract. Tokenization can expedite the transfer of asset ownership, offering instant settlements. This initiative aims to reduce operational friction in meeting margin calls, especially during market pressures. Source

Plus, 9 more exclusive stories to help you stay ahead of the curve!

Subscribe now to empower your FinTech journey with the essential insights and connections you need to succeed. Don’t miss out – join our vibrant community today!

More information on www.bussmannadvisory.com. The latest edition of the FinTech Ecosystem Newsletter is here:

Unlock the Future of Finance: Empower Your Team with Cutting-Edge FinTech & AI Insights!

Don’t miss out on the chance to empower your team with crucial knowledge about disruptive technologies, FinTech, AI and Digital Assets! As trusted advisors to CEOs, CxOs, and Boards, we help you to tackle scale-up challenges and seize digital opportunities.

We offer expert advisory services for executive teams and customized in-person or virtual courses on relevant topics. Elevate your organization’s understanding of the future of finance – contact us at info@bussmannadvisory.com for more details and let’s transform your business together.

Join our community of 50,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter provided by Bussmann Advisory. Gain insights into disruptive technologies, industry updates, and success stories from our portfolio companies.

This week’s must-know stories:

Plus, 9 more exclusive stories to help you stay ahead of the curve!

Subscribe now to empower your FinTech journey with the essential insights and connections you need to succeed. Don’t miss out – join our vibrant community today!

More information on www.bussmannadvisory.com. The latest edition of the FinTech Ecosystem Newsletter is here:

Unlock the Future of Finance: Empower Your Team with Cutting-Edge FinTech & AI Insights!

Don’t miss out on the chance to empower your team with crucial knowledge about disruptive technologies, FinTech, AI and Digital Assets! As trusted advisors to CEOs, CxOs, and Boards, we help you to tackle scale-up challenges and seize digital opportunities.

We offer expert advisory services for executive teams and customized in-person or virtual courses on relevant topics. Elevate your organization’s understanding of the future of finance – contact us at info@bussmannadvisory.com for more details and let’s transform your business together.

Please note that this newsletter reflects Bussmann Advisory’s and Oliver Bussmann’s personal views and not those of any organization we are involved with. This newsletter is for educational purposes only and none of its content should be construed as investment or financial advice of any kind.

Join our community of 50,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter provided by Bussmann Advisory. Gain insights into disruptive technologies, industry updates, and success stories from our portfolio companies.

This week’s must-know stories:

Plus, 9 more exclusive stories to help you stay ahead of the curve!

Subscribe now to empower your FinTech journey with the essential insights and connections you need to succeed. Don’t miss out – join our vibrant community today!

More information on www.bussmannadvisory.com. The latest edition of the FinTech Ecosystem Newsletter is here:

Unlock the Future of Finance: Empower Your Team with Cutting-Edge FinTech & AI Insights!

Don’t miss out on the chance to empower your team with crucial knowledge about disruptive technologies, FinTech, AI and Digital Assets! As trusted advisors to CEOs, CxOs, and Boards, we help you to tackle scale-up challenges and seize digital opportunities.

We offer expert advisory services for executive teams and customized in-person or virtual courses on relevant topics. Elevate your organization’s understanding of the future of finance – contact us at info@bussmannadvisory.com for more details and let’s transform your business together.

Please note that this newsletter reflects Bussmann Advisory’s and Oliver Bussmann’s personal views and not those of any organization we are involved with. This newsletter is for educational purposes only and none of its content should be construed as investment or financial advice of any kind.

Join our community of 50,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter provided by Bussmann Advisory. Gain insights into disruptive technologies, industry updates, and success stories from our portfolio companies.

This week’s must-know stories:

Plus, 9 more exclusive stories to help you stay ahead of the curve!

In the upcoming Teradata event “Fuel your future at Possible” on September 12 in London, Oliver Bussmann, CEO of Bussmann Advisory, will join esteemed industry experts in the panel discussion “Discover what’s next with thought leaders”. This insightful Q&A session, moderated by Martin Willcox, VP Analytics & Architecture at Teradata, will delve into the latest industry insights from top thought leaders. The event promises a deep exploration of innovation driven by generative AI and harmonized data. Don’t miss out; secure your spot now: Event Registration.

Subscribe now to empower your FinTech journey with the essential insights and connections you need to succeed. Don’t miss out – join our vibrant community today!

More information on www.bussmannadvisory.com. The latest edition of the FinTech Ecosystem Newsletter is here:

Unlock the Future of Finance: Empower Your Team with Cutting-Edge FinTech & AI Insights!

Don’t miss out on the chance to empower your team with crucial knowledge about disruptive technologies, FinTech, AI and Digital Assets! As trusted advisors to CEOs, CxOs, and Boards, we help you to tackle scale-up challenges and seize digital opportunities.

We offer expert advisory services for executive teams and customized in-person or virtual courses on relevant topics. Elevate your organization’s understanding of the future of finance – contact us at info@bussmannadvisory.com for more details and let’s transform your business together.

Please note that this newsletter reflects Bussmann Advisory’s and Oliver Bussmann’s personal views and not those of any organisation we are involved with. This newsletter is for educational purposes only and none of its content should be construed as investment or financial advice of any kind.

Join our community of 50,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter provided by Bussmann Advisory. Gain insights into disruptive technologies, industry updates, and success stories from our portfolio companies.

This week’s must-know stories:

Plus, 9 more exclusive stories to help you stay ahead of the curve!

In the upcoming Teradata event “Fuel your future at Possible” on September 12 in London, Oliver Bussmann, CEO of Bussmann Advisory, will join esteemed industry experts in the panel discussion “Discover what’s next with thought leaders”. This insightful Q&A session, moderated by Martin Willcox, VP Analytics & Architecture at Teradata, will delve into the latest industry insights from top thought leaders. The event promises a deep exploration of innovation driven by generative AI and harmonized data. Don’t miss out; secure your spot now: Event Registration.

Subscribe now to empower your FinTech journey with the essential insights and connections you need to succeed. Don’t miss out – join our vibrant community today!

More information on www.bussmannadvisory.com. The latest edition of the FinTech Ecosystem Newsletter is here:

Unlock the Future of Finance: Empower Your Team with Cutting-Edge FinTech & AI Insights!

Don’t miss out on the chance to empower your team with crucial knowledge about disruptive technologies, FinTech, AI and Digital Assets! As trusted advisors to CEOs, CxOs, and Boards, we help you to tackle scale-up challenges and seize digital opportunities.

We offer expert advisory services for executive teams and customized in-person or virtual courses on relevant topics. Elevate your organization’s understanding of the future of finance – contact us at info@bussmannadvisory.com for more details and let’s transform your business together.

Please note that this newsletter reflects Bussmann Advisory’s and Oliver Bussmann’s personal views and not those of any organization we are involved with. This newsletter is for educational purposes only and none of its content should be construed as investment or financial advice of any kind.

Join our community of 50,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter provided by Bussmann Advisory. Gain insights into disruptive technologies, industry updates, and success stories from our portfolio companies.

This week’s must-know stories:

Plus, 9 more exclusive stories to help you stay ahead of the curve!

Subscribe now to empower your FinTech journey with the essential insights and connections you need to succeed. Don’t miss out – join our vibrant community today!

More information on www.bussmannadvisory.com. The latest edition of the FinTech Ecosystem Newsletter is here:

Unlock the Future of Finance: Empower Your Team with Cutting-Edge FinTech & AI Insights!

Don’t miss out on the chance to empower your team with crucial knowledge about disruptive technologies, FinTech, AI and Digital Assets! As trusted advisors to CEOs, CxOs, and Boards, we help you to tackle scale-up challenges and seize digital opportunities.

We offer expert advisory services for executive teams and customized in-person or virtual courses on relevant topics. Elevate your organization’s understanding of the future of finance – contact us at info@bussmannadvisory.com for more details and let’s transform your business together.

Please note that this newsletter reflects Bussmann Advisory’s and Oliver Bussmann’s personal views and not those of any organisation we are involved with. This newsletter is for educational purposes only and none of its content should be construed as investment or financial advice of any kind.